Tag: retirement planning

Money Mettle: How to Build Financial Resilience

In today’s fast-paced and unpredictable world, achieving financial resilience is more critical than ever. Economic downturns, job loss, unexpected expenses – these are just a few of the curveballs life can throw our way. However, by mastering the art of financial resilience, individuals can build a strong foundation to weather any storm and emerge stronger on the other side.

Read moreThe 5 Most Urgent Financial Planning Mistakes to Avoid

Financial planning is essential for achieving long-term success and securing your future. However, even with the best intentions, many individuals make mistakes that can hinder their progress. As a fiduciary fee-only independent financial advisor, I’m here to help you avoid these common pitfalls and set you on the path to financial well-being. 1. Lack of […]

Read moreHow to Know if a Financial Advisor is a Fiduciary

Do you want to know if your financial advisor is a fiduciary? Just ask. The easiest way to find out if your advisor is a fiduciary is simply to ask. If your advisor says they’re not a fiduciary, ask why. The advisor should offer a clear, concise and logical explanation. They also should be willing and […]

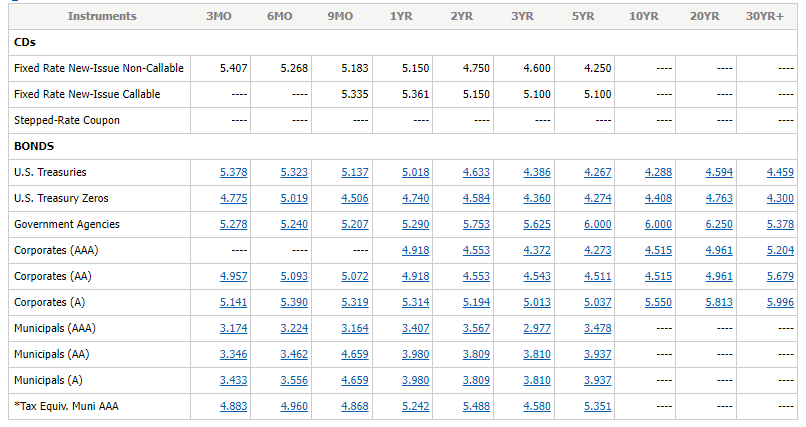

Read moreDon’t Let Your Cash Sit Idle: Invest Wisely for Better Returns

Stop Losing Money: Why Parking Cash in Banks Is Costing You Big Time! In today’s financial landscape, letting your cash sit idle in a bank account or locking it into CDs with teaser rates that quickly dwindle is a costly mistake. Instead, savvy investors are opting for smarter ways to manage their idle cash and […]

Read moreMaximizing Your Retirement: Understanding Required Minimum Distribution (RMD) Requirements

As you approach retirement age, it’s essential to understand the intricacies of Required Minimum Distributions (RMDs) to optimize your financial plan. RMDs dictate the minimum amount you must withdraw from your retirement accounts each year, ensuring that you deplete them over time. However, navigating these requirements can be complex, especially considering the variations based on […]

Read moreUnlocking Financial Security: Finding the Best Tax Preparer Near You

Introduction: When it comes to handling your finances, especially taxes, trust is paramount. Yet, many people overlook the importance of thoroughly vetting their tax preparer, despite the sensitive nature of the information they handle. At Shore Financial Planning, we understand the significance of selecting the right tax professional, which is why we’ve compiled these eight […]

Read moreReduce Your Taxes & Grow Wealth Now

Discover the Power of Proactive Tax Planning to Permanently Reduce Taxes and Grow Wealth. How it Impacts the Business and/or Real Estate Owner: Taxes can be the largest recurring expense for business and real estate owners, often delaying or even destroying wealth-building plans. On average, individuals worldwide pay 30-50% of their income in taxes, including […]

Read moreCost Segregation – What You Need to Know

COST SEGREGATION Is an IRS APPROVED Method to reduce or eliminate federal income taxes. We provide cost segregation reporting for federal income tax reduction by calculating costs of property components and segregating each to the correct depreciation lives, including short-life classifications. Shorter depreciation time lowers taxable income. Why Do a Cost Segregation Study? Beyond the […]

Read moreSee If Your Business Is Eligible For The QBI Deduction

The Qualified Business Income (QBI) deduction and related rules and guidance can be difficult to navigate. Also, there are several factors and issues that eligible business owners must consider. Additionally, to help make the analysis easier, we have created the “Am I Eligible For A Qualified Business Income (QBI) Deduction?” flowchart. It addresses some of […]

Read more2022 – THE END Of The Greatest Bond Market Bubble In Financial History

The bond market today resembles the stock market in 1998-2000 and the real estate market in 2006-2007!!! Both Asset Bubbles were predictable and ended badly for investors!!! How is it possible to make such a claim??? Risk vs. Reward Analysis Based On Valuations We are at a rare point in history where the risk/reward analysis […]

Read more