Our Wealth Management approach involves disciplined application of three major themes:

- Broad diversification of risk

- Low costs

- Low taxes (for taxable investors).

These factors allow investors the chance to reduce portfolio risk and enhance long term wealth effectively and efficiently.

NOTE: YOU are in control of these 3 variables!!!

- PASSIVE INVESTING – Academically Oriented Wealth Management Investment Philosophy which is grounded in Modern Portfolio Theory. This philosophy emphasizes broad diversification of risk which leads to increased return.

- ASSET ALLOCATION to help ensure Long-Term Investment Success. We develop an appropriate asset allocation strategy that is customized to meet the goals and time horizon for each client. Research has shown this approach to be a key determining factor to a portfolio’s return. Efforts to time the market or underweight or overweight asset classes add little value over time and in fact can dramatically limit returns.

- MANAGE RISK on an ongoing basis

- LOW COSTS – FEES AND EXPENSES COME IN MANY UNEXPECTED FORMS

There is more to consider than just basis points and trading costs, including higher taxes and internal investment expenses. This is especially true with active management. These additional costs offset or reduce overall performance. Instead, our investment approach focuses on minimizing costs and optimizing returns to help client’s reach their goals faster. - TAX FOCUSED INVESTING CAN ENHANCE RETURNS – We minimize taxes by focusing on investment location, gain/loss harvesting, charitable giving and passive investing. Over time these strategies help clients pay less taxes and enhance their overall investment returns.

Finding investment winners by looking at the past or attempting to forecast the future, isn’t the key to successful investing.

Our wealth management team creates investment portfolios that are carefully designed to help investors reduce risk, improve returns, and create a reliable income stream.

There are three key principles we follow to help protect your nest egg:

1.) KEEP COSTS LOW

The best predictor of future returns is the cost of your investments. In other words, low-cost investments are expected to provide better returns than high-cost investments.

For that reason, we build our retirement portfolios using ultra-low-cost index funds. This helps to improve the success rate of your retirement plan and reduce unnecessary risk.

2.) OWN TAX-EFFICIENT INVESTMENTS

Warren Buffet says his favorite holding period is forever. We agree.

While buying an investment and holding it forever isn’t practical for most retirees, we create portfolios with “low turnover.”

Every time an investment is bought or sold (i.e “turned over”), costs are incurred. Not just obvious costs like transaction fees and taxes, but hidden costs like bid-ask spreads.

These costs eat away at your investment returns. To protect your investment returns and mitigate taxes, we target investments with low turnover.

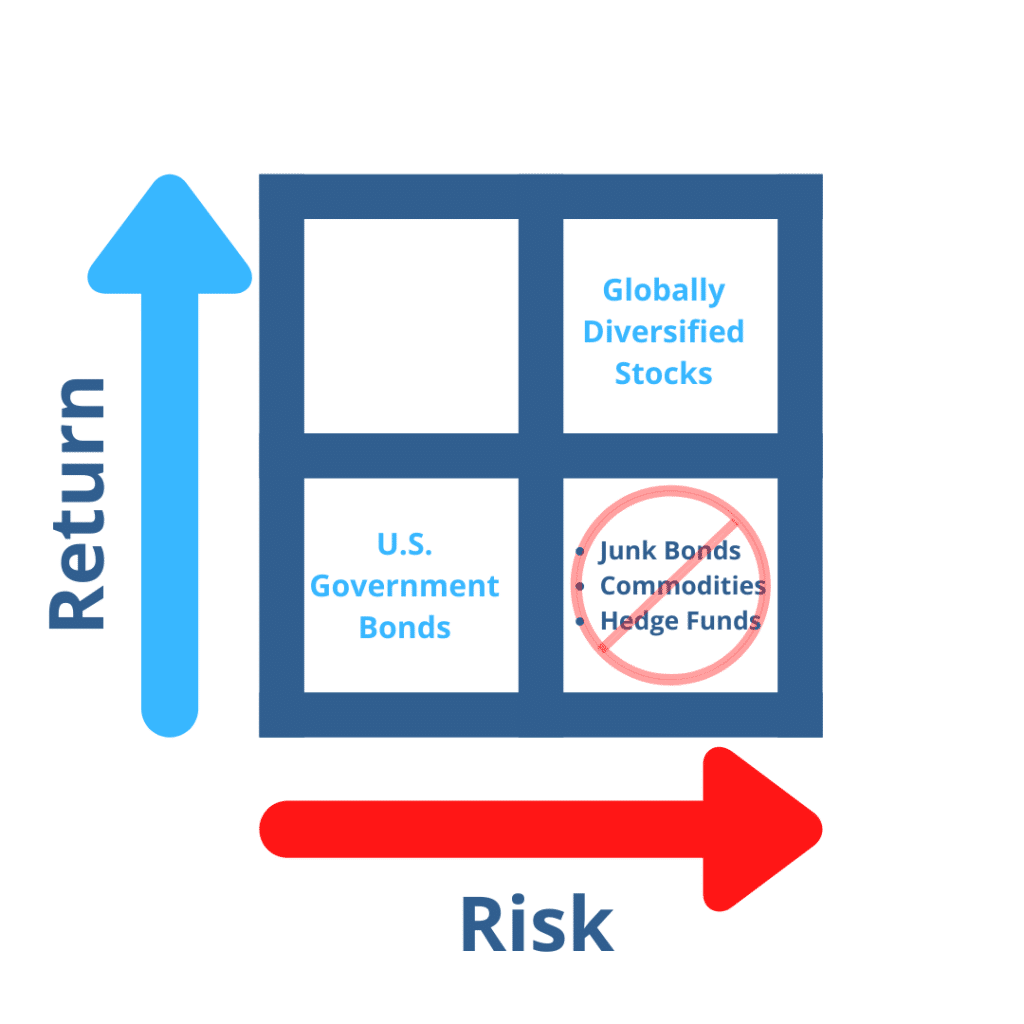

3.) OWN THE RIGHT ASSET CLASSES

Not all investments are created equal. Just because you can invest your money into something (e.g. Gold), does not mean you should.

We only invest in asset classes that:

- Have been proven through academic research to provide superior risk-adjusted returns

- Work well when invested together in a diversified portfolio (e.g. low and/or negative correlation to each other)

For example, corporate bonds can behave like stocks during catastrophic events. That does not provide the diversification needed by a retirement investor.

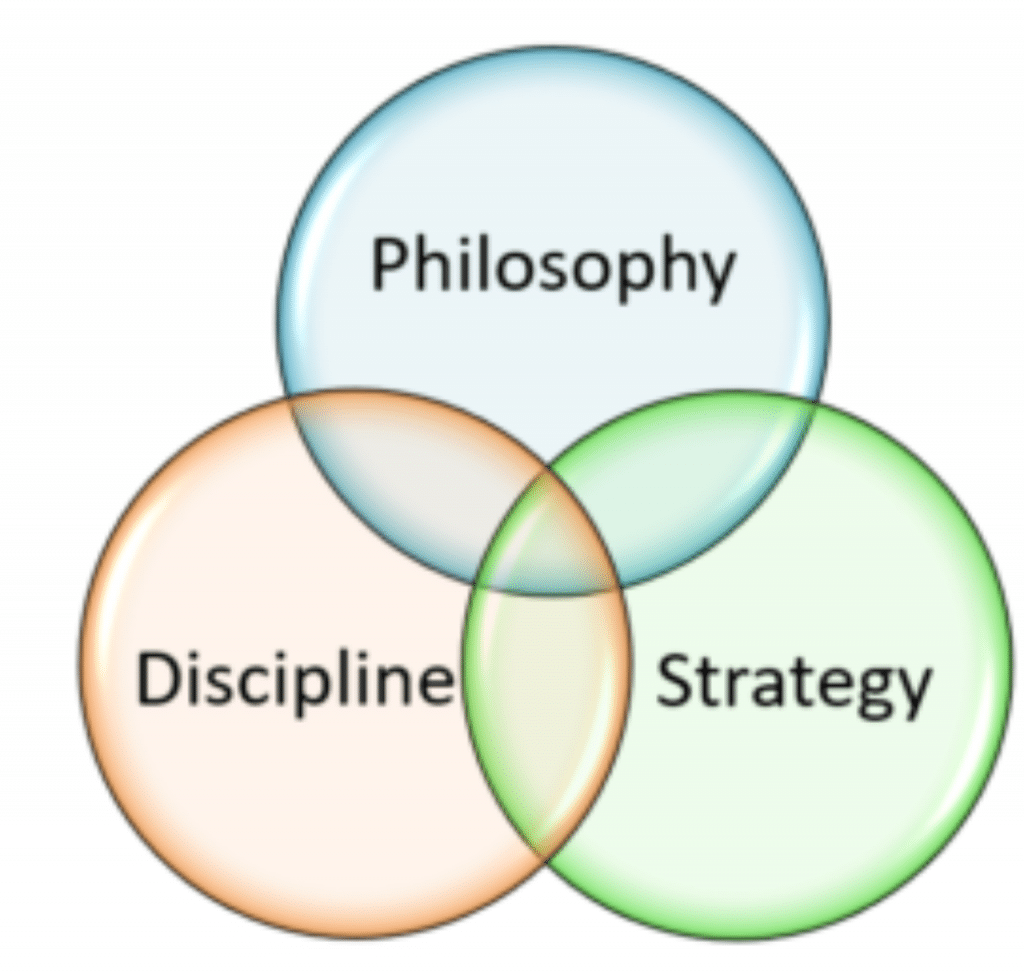

Three Keys to Success to Long-Term Investment Success

Philosophy, strategy, and discipline are the keys to long-term investment success.

An investment portfolio is a tool that’s used to achieve your financial goals. The markets are the same for everyone, but how you interact with them is unique to you.

The best portfolios are simple, low-cost, diversified, and tax-efficient.

I believe successful investors possess three attributes. They have a sensible investment philosophy, develop a prudent strategy for their needs using low-cost funds, and stick to their plan with die-hard discipline. It takes all three traits to succeed long-term.

1. Embrace a Passive Philosophy

Philosophy is an investor’s underlying core belief about how markets work and how to best invest in them. The two main philosophies are active and passive.

- Active investors believe there is enough inefficiency in market prices to profit from trading after all costs.

- Passive investors believe the markets are more efficient than they are at determining prices and accept a market return through index-tracking investments.

The academic evidence is overwhelmingly in favor of passive investors. Those who accepted market returns have performed meaningfully better on average than active investors who try to outperform the markets. After structural costs (fees, expenses, commissions) and behavioral costs (poor security selection and timing errors), the net result of active investors falls far short of passive returns.

I believe passive investing works best for most people. My belief is based on years of study and over two decades of Wall Street experience as a professional trader/money manger.

The most prudent way for investors to reduce portfolio risk and enhance wealth is through “passive investing.” This involves investing in broadly diversified, low cost and low tax asset class mutual funds and index mutual funds that effectively and efficiently capture market level returns at market level risk.

2. Create a Portfolio Strategy

Strategy puts philosophy into practice. The opportunity to earn market returns extend to every person, however, no one strategy is universal.

Strategy is the unique way each investor personalizes the universal passive philosophy. Every investor should customize their portfolio to their own needs and ability to handle risk.

Strategy starts with an assessment of your financial situation, long-term goals, and ability to withstand short-term losses. This leads to a prudent asset allocation among risky assets, less risky assets and risk-less assets, and to an asset location plan for tax purposes when applicable.

3. Maintain Discipline

Maintaining discipline is the hardest part of investing. Distractions are everywhere. Adjusting a portfolio to keep up with the “news” is futile. Poor relative performance usually results when an investor attempts to trade on information that’s already known and widely disseminated in the marketplace. It’s easy to get caught up in the hype and break discipline, even as an index investor.

There are ways to improve discipline. One way is to keep your portfolio strategy simple. Less complexity means less temptation to make frequent changes. Holding a few, low-cost, broadly diversified funds in a portfolio helps maintain discipline.

As a fiduciary, our job is to make investment decisions that are in your best interest. This means ignoring the daily headlines and sticking with evidence-based solutions.

Want to learn more about how we allocate portfolios and manage investments? Click Here To Schedule Your No-Obligation Consultation.