You Need A Plan To Build Wealth

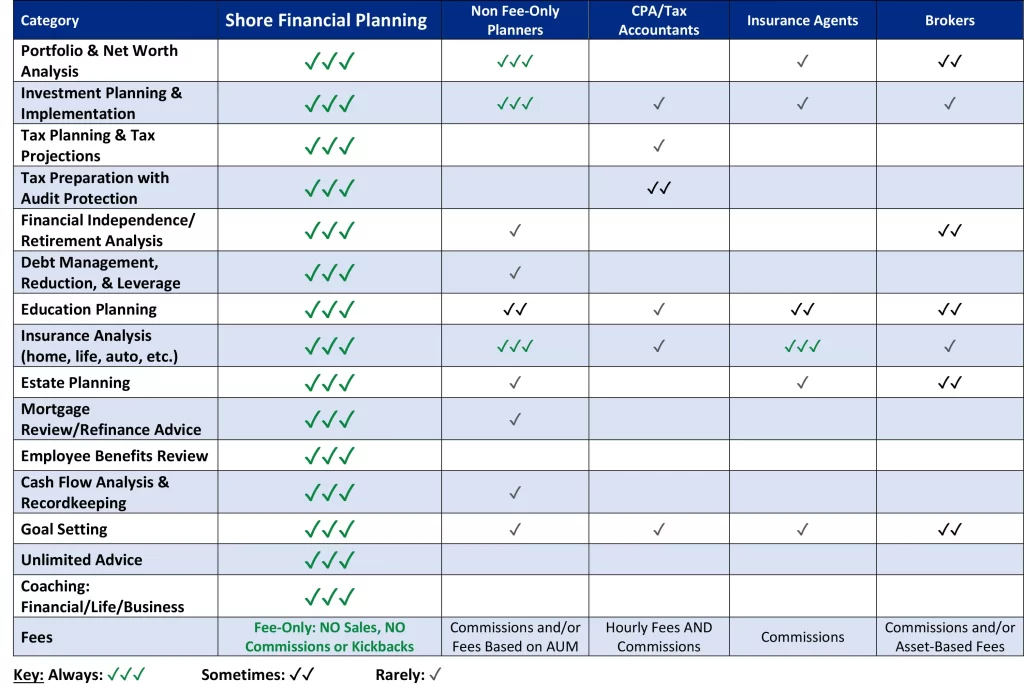

Shore Financial Planning is a fee-only tax and investment planning firm. Our core belief is that a Financial Plan is an absolutely necessary first step to making consistently smart financial decisions to achieve your financial and life goals. It gives clarity, congruency, and consistency to your actions so you know exactly what financial tasks to accomplish, in what order, to reach your goal of financial freedom.

Begin With The End In Mind

You have to know where you want to end up before you can plan the most efficient path to get there.

Wealth building done right follows a process

Your personal skills, resources and abilities determine the perfect wealth plan uniquely designed to your unique needs.

The process connects the internal (your values, skills, and resources) with the external (your actions in daily life) through the blueprint of your plan.

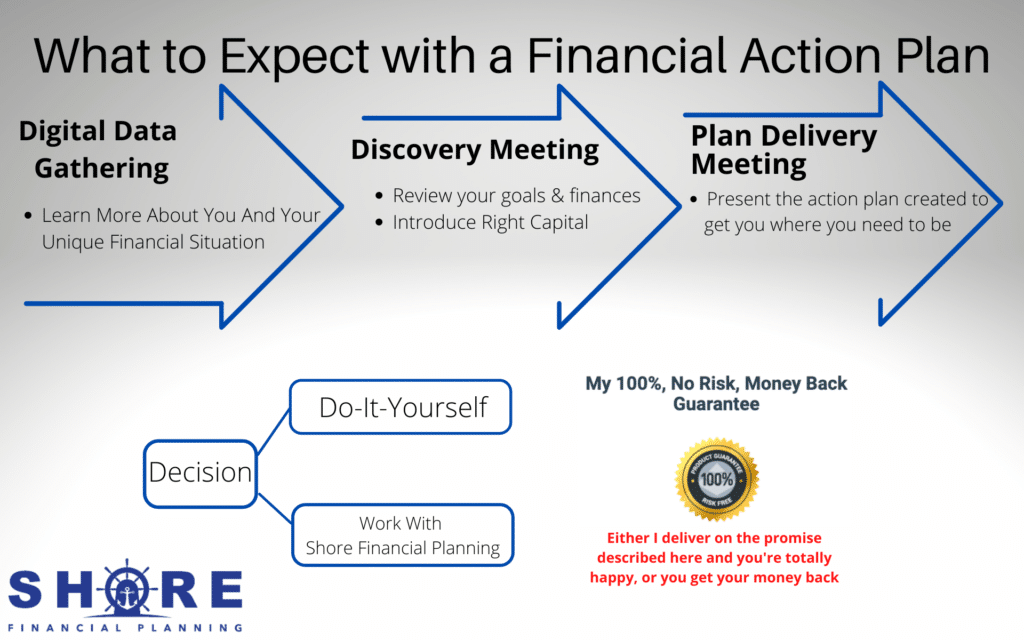

STEP #1 - Digital Data Gathering

Learn more about you and your unique financial situation

We will collect data remotely through our secure software.

- -Online Discovery Interview

- -Personal Planning Profile

- -Securely Share Your Financial Details

- Tax Return(s)

- W2 & most recent pay stub

- Social Security Statement (create account here if needed)

- Retirement & Brokerage Account Statements

- Other Asset Details (checking/savings/CDs/Bonds/etc…)

- Debt Details (mortgage statement & other loan details)

- Insurance Documents (Health, Disability, Life, Homeowners, Auto, Umbrella, Business, Other)

- Estate Planning Documents (Wills, Trusts, Living Will, Financial Power of Attorney, Advance Directives)

STEP #2 - Discovery Meeting

This meeting is where we review your goals and finances, and assess your strengths and weaknesses to capitalize on YOUR unique skills and competitive advantages.

Introduce you to our financial planning software – Right Capital which will help you organize your finances.

This meeting can be held in person or via Zoom (Our office conference room is large and can accommodate social distancing)

STEP #3 - Plan Delivery Meeting

We will present your unique Financial Plan that will be a reflection of your life today and where you want to be in the future. The financial plan will be unique to you and an expression of your life.

Actionable, prioritized, detailed advice to accomplish your financial goals.

Implement Your Financial Plan - Choose Your Path?

No Risk, Money Back Guarantee

I am confident that I can and will provide you with value in excess of the fee to complete your Financial Action Plan through:

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

- Tax Savings (tax planning)

- Investment Advice (reducing hidden/unnecessary expenses)

- Portfolio Analysis (help improve your portfolio)

- Cash Optimization

- Insurance Analysis

- Business Planning

- Entity Structuring

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

Either I deliver on my promise described here and you’re totally happy, or you get your money back.

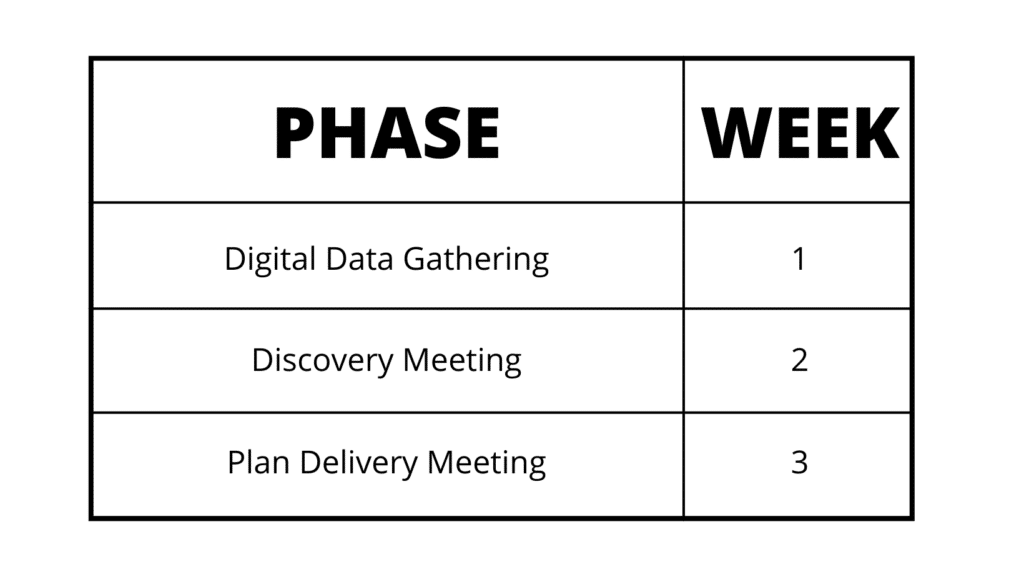

Timeframe

To complete your Comprehensive Financial Plan, it will take approximately 3 weeks to complete following the signing of this proposal.