Category: Uncategorized

How Much Should I Be Saving for Retirement?

When it comes to saving for retirement, experts recommend saving 10% to 15% of your income every month, but you can calculate a more personalized goal by following four simple steps. As a rule of thumb, most experts recommend an annual retirement savings goal of 10% to 15% of your pretax income. High earners generally […]

Read moreUnlocking Financial Freedom: How We Secure Your Money and Future!

Introduction:Are you tired of watching your hard-earned money vanish into the black hole of taxes? Do you dream of a future where you can retire comfortably and pursue your passions without financial worry? At Shore Financial Planning, we understand the frustrations and uncertainties that come with managing your finances. That’s why we’re here to revolutionize […]

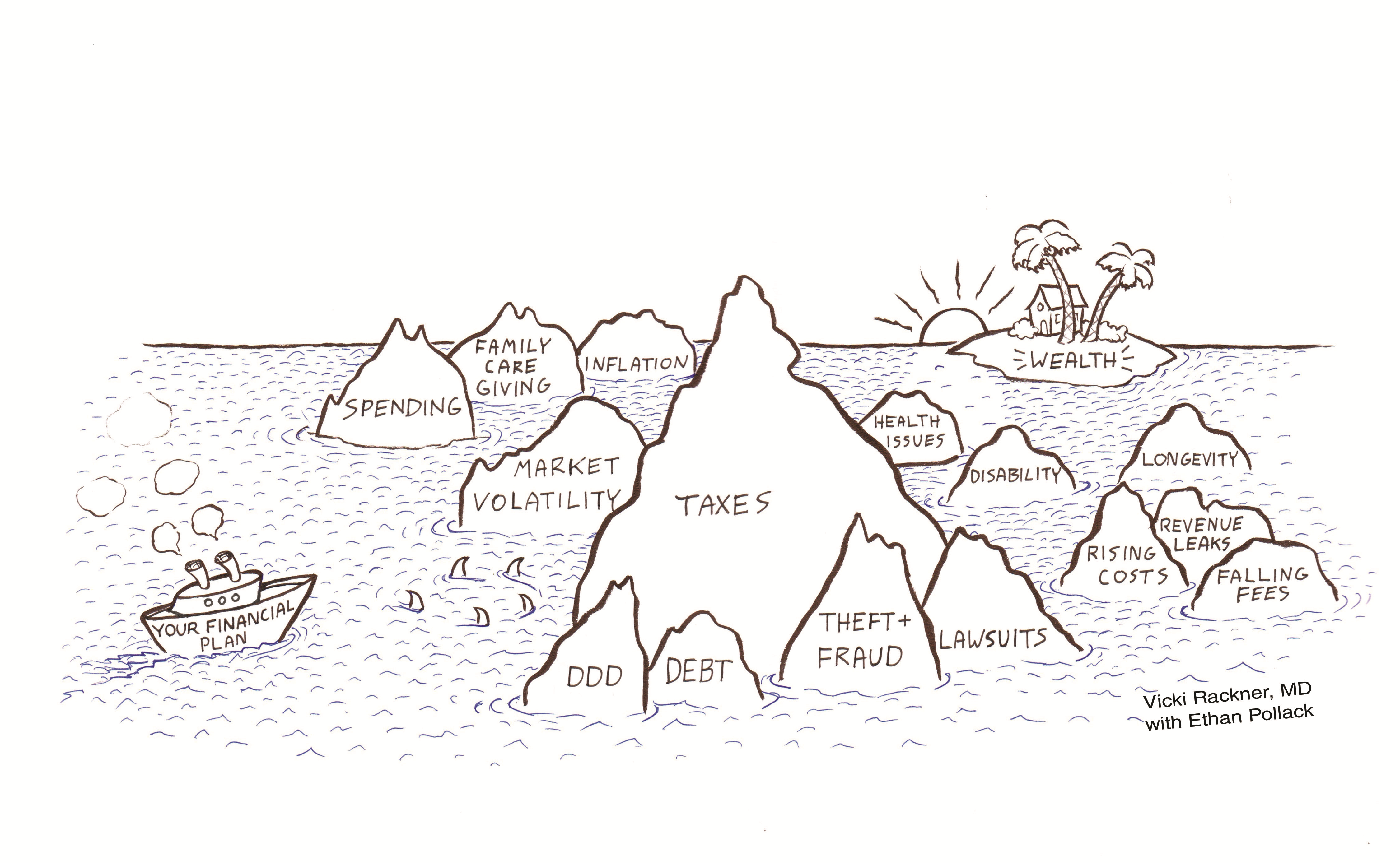

Read moreUnlock Your Financial Freedom: Why a Comprehensive Financial Plan is Your Key to Success

Are you dreaming of a financially independent future? Planning to invest or retire soon? It’s time to grab hold of the reins and steer your financial journey towards success. But before you dive into investments or bid farewell to the daily grind, there’s a crucial step you can’t afford to overlook: crafting a comprehensive financial […]

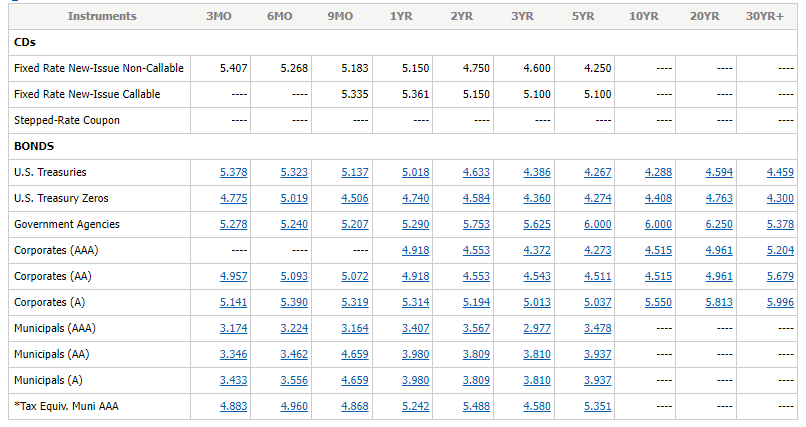

Read moreDon’t Let Your Cash Sit Idle: Invest Wisely for Better Returns

Stop Losing Money: Why Parking Cash in Banks Is Costing You Big Time! In today’s financial landscape, letting your cash sit idle in a bank account or locking it into CDs with teaser rates that quickly dwindle is a costly mistake. Instead, savvy investors are opting for smarter ways to manage their idle cash and […]

Read moreMaximizing Your Retirement: Understanding Required Minimum Distribution (RMD) Requirements

As you approach retirement age, it’s essential to understand the intricacies of Required Minimum Distributions (RMDs) to optimize your financial plan. RMDs dictate the minimum amount you must withdraw from your retirement accounts each year, ensuring that you deplete them over time. However, navigating these requirements can be complex, especially considering the variations based on […]

Read moreUnlocking Financial Security: Finding the Best Tax Preparer Near You

Introduction: When it comes to handling your finances, especially taxes, trust is paramount. Yet, many people overlook the importance of thoroughly vetting their tax preparer, despite the sensitive nature of the information they handle. At Shore Financial Planning, we understand the significance of selecting the right tax professional, which is why we’ve compiled these eight […]

Read moreFinancial Planning Software

Trying to stay on top of your financial life? Well, now you can with easy access to your finances anytime, anywhere. We use cutting edge technology to enable you to access your financial information via a web portal or from your phone. View your Net Worth View & link your accounts Track your spending Even […]

Read more2023 Tax Guide

There are lots of important numbers that taxpayers need to keep in mind. In some cases, those numbers are annual limits that change each year. Other times, the figures do not often change, but are used frequently. To help taxpayers, we’ve created the two-page “Important Numbers” summary guide. This quick reference guide covers the most […]

Read more2022 – THE END Of The Greatest Bond Market Bubble In Financial History

The bond market today resembles the stock market in 1998-2000 and the real estate market in 2006-2007!!! Both Asset Bubbles were predictable and ended badly for investors!!! How is it possible to make such a claim??? Risk vs. Reward Analysis Based On Valuations We are at a rare point in history where the risk/reward analysis […]

Read moreHow To Choose A Financial Advisor

Choosing your advisor may be one of the most important financial decisions you make. Your advisor will be your partner in making financial decisions and choosing your investment strategy. Many people call themselves financial advisors or financial planners. Yet, not all financial advisors are created equal! Let’s take a look at how to find the […]

Read more