Unlocking Financial Security: Finding the Best Tax Preparer Near You

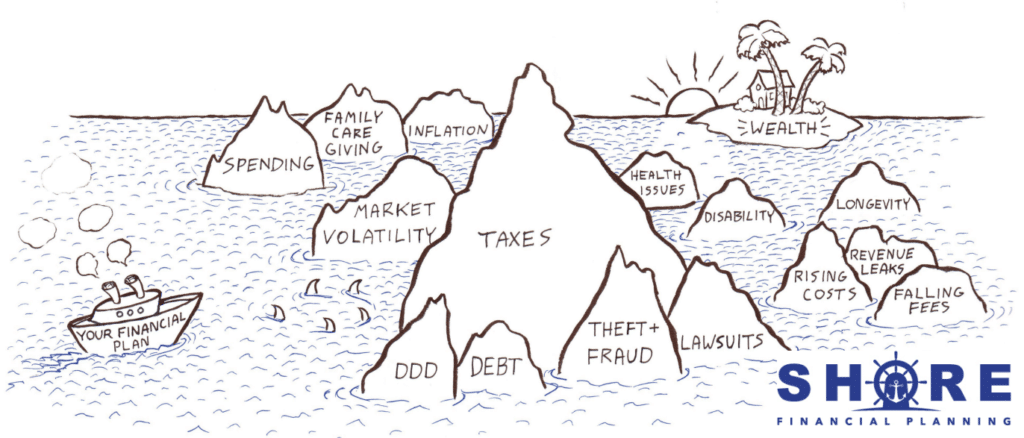

Introduction: When it comes to handling your finances, especially taxes, trust is paramount. Yet, many people overlook the importance of thoroughly vetting their tax preparer, despite the sensitive nature of the information they handle. At Shore Financial Planning, we understand the significance of selecting the right tax professional, which is why we’ve compiled these eight […]

Read moreReduce Your Taxes & Grow Wealth Now

Discover the Power of Proactive Tax Planning to Permanently Reduce Taxes and Grow Wealth. How it Impacts the Business and/or Real Estate Owner: Taxes can be the largest recurring expense for business and real estate owners, often delaying or even destroying wealth-building plans. On average, individuals worldwide pay 30-50% of their income in taxes, including […]

Read moreCost Segregation – What You Need to Know

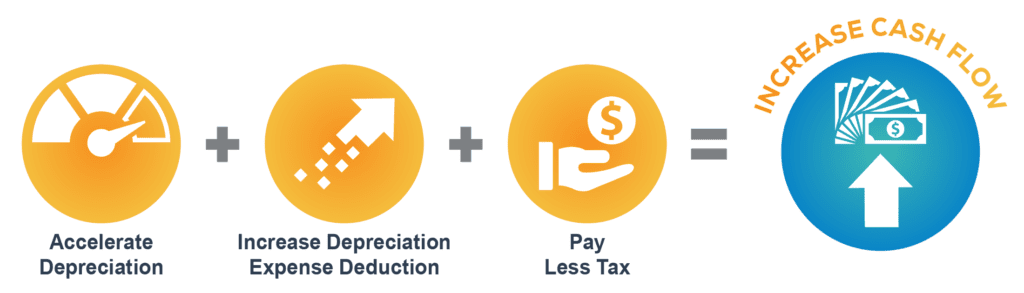

COST SEGREGATION Is an IRS APPROVED Method to reduce or eliminate federal income taxes. We provide cost segregation reporting for federal income tax reduction by calculating costs of property components and segregating each to the correct depreciation lives, including short-life classifications. Shorter depreciation time lowers taxable income. Why Do a Cost Segregation Study? Beyond the […]

Read moreSee If Your Business Is Eligible For The QBI Deduction

The Qualified Business Income (QBI) deduction and related rules and guidance can be difficult to navigate. Also, there are several factors and issues that eligible business owners must consider. Additionally, to help make the analysis easier, we have created the “Am I Eligible For A Qualified Business Income (QBI) Deduction?” flowchart. It addresses some of […]

Read moreBusiness Owner and/or 1099 Employee Tax & Financial Planning Checklist

Running your own business (including 1099 work) introduces different elements that aren’t always easy to factor into your personal financial plan. With this checklist you will be able to better navigate these different elements and find more ways to tie them in with their personal financial goals. This checklist covers some key issues a business […]

Read moreFinancial Planning Software

Trying to stay on top of your financial life? Well, now you can with easy access to your finances anytime, anywhere. We use cutting edge technology to enable you to access your financial information via a web portal or from your phone. View your Net Worth View & link your accounts Track your spending Even […]

Read moreJoseph Vecchio CPA, CFP®, PFS™, MBA

What I do & Who I do it for: I help real estate investors and small business owners permanently reduce taxes and grow wealth through a process called ‘zero tax advisory’, empowering them to more efficiently achieve—and surpass—their financial goals. Why I do it: Small business owners and real estate investors are overpaying their taxes […]

Read moreRental Real Estate Investor Checklist

Rental real estate offers investors substantial tax benefits. Shore Financial helps investors manage the benefits of rental real estate. Many people like rental income because it seems passive and simple, until it isn’t so passive … or simple! Using this checklist will help you understand the challenges and nuances that exist with owning a rental […]

Read more2023 Tax Preparation Checklist

Filing your taxes is never fun. Whether working with a tax professional or doing it on their own, you may feel stress. We hope this guide will help better equipped you to navigate the process of gathering your documents for filing your 2023 tax return. This checklist covers the key issues to consider when preparing […]

Read more2023 Tax Guide

There are lots of important numbers that taxpayers need to keep in mind. In some cases, those numbers are annual limits that change each year. Other times, the figures do not often change, but are used frequently. To help taxpayers, we’ve created the two-page “Important Numbers” summary guide. This quick reference guide covers the most […]

Read more