Tag: fee-only advisor

Elder Care and College Planing, a Sticky Situation

Many individuals find themselves in the sticky situation where elder care planning for a parent and applying for financial aid has placed financial strain upon them. Parents want to do right by both their aging parent and child, but given the collision of events they may have to make a hard choice. To set the […]

Read moreA Financial Planning Checklist: Cash Flow

The cash comes in. The cash goes out. We’re all familiar with how cash flow works. However, are you taking the proper steps to track and manage this crucial piece of your financial plans. That’s why we’ve created a financial planning checklist that addresses cash flow management. Your Role In The Conversation Generally speaking, people […]

Read moreEconomics 101 & The Stock Market Bubble

As a professional trader in my prior life (between the years of 1997 – 2019) I became conversant with the stock market and learned the truth about Wall Street. I was fortunate to become financially independent enough to start my own financial planning firm – Shore Financial Planning, located in Monmouth Beach, NJ. Throughout my […]

Read moreHow do Fee-Only Financial Advisors get Paid?

There are two basic advisor payment structures to be aware of, fee-only and commissions. Fee-Only advisors do not accept any fees or compensation based on product sales. On the other hand, commission-based agents and brokers are paid commissions from the products they sell. Fee-only financial advisors, such as the members of our team always operate as fiduciaries. […]

Read moreWhy “Fiduciary” is critical when Choosing a Financial Advisor

When choosing a financial advisor you want someone who has only your best interest in mind. Often times non-fiduciaries may steer you towards risky or sub-par investments that pay them a bigger commission. Fiduciary Financial Advisors Do Their Research Fiduciaries must make sure their recommendations are based on accurate and complete information. This means that […]

Read moreThree Reasons Why to Select a Fiduciary Advisor

A Fiduciary Advisor Does Their Research Fiduciary advisors must make sure their recommendations are based on accurate and complete information. That means they are required to thoroughly analyze your accounts, goals and circumstances before recommending that you buy an investment or use a particular savings vehicle. Fiduciaries must then monitor their recommendation to make sure […]

Read moreWhy Should I Hire a Fee-Only Financial Advisor?

As you get older, busier and hopefully wealthier, your financial goals get more complicated. A fee-only financial advisor is paid directly by the client on a transparent and pre-arranged payment plan. This can be an hourly or project rate, monthly retainer, or percentage of investments managed. Fee-only financial planners are registered investment advisors with a […]

Read moreFee-Only vs. Fee-Based Advisor Compensation: What’s the Difference

A fee-only advisor is compensated only by the fees he or she directly charges and not by commissions earned from the sale of a financial product. The fee they charge could be hourly, a flat retainer, or based on a percentage of your investment assets they manage. A major benefit of working with a […]

Read moreThree Important Criteria to Consider When Choosing a Financial Advisor.

Fee-Only: Compensated only by the client without earning commission of any kind for product sales or referrals. Fiduciary: Legally sworn and obligated to always place the interest of the client ahead of their own. Independent: Not affiliated with any brokerage firm, bank, or insurance company.

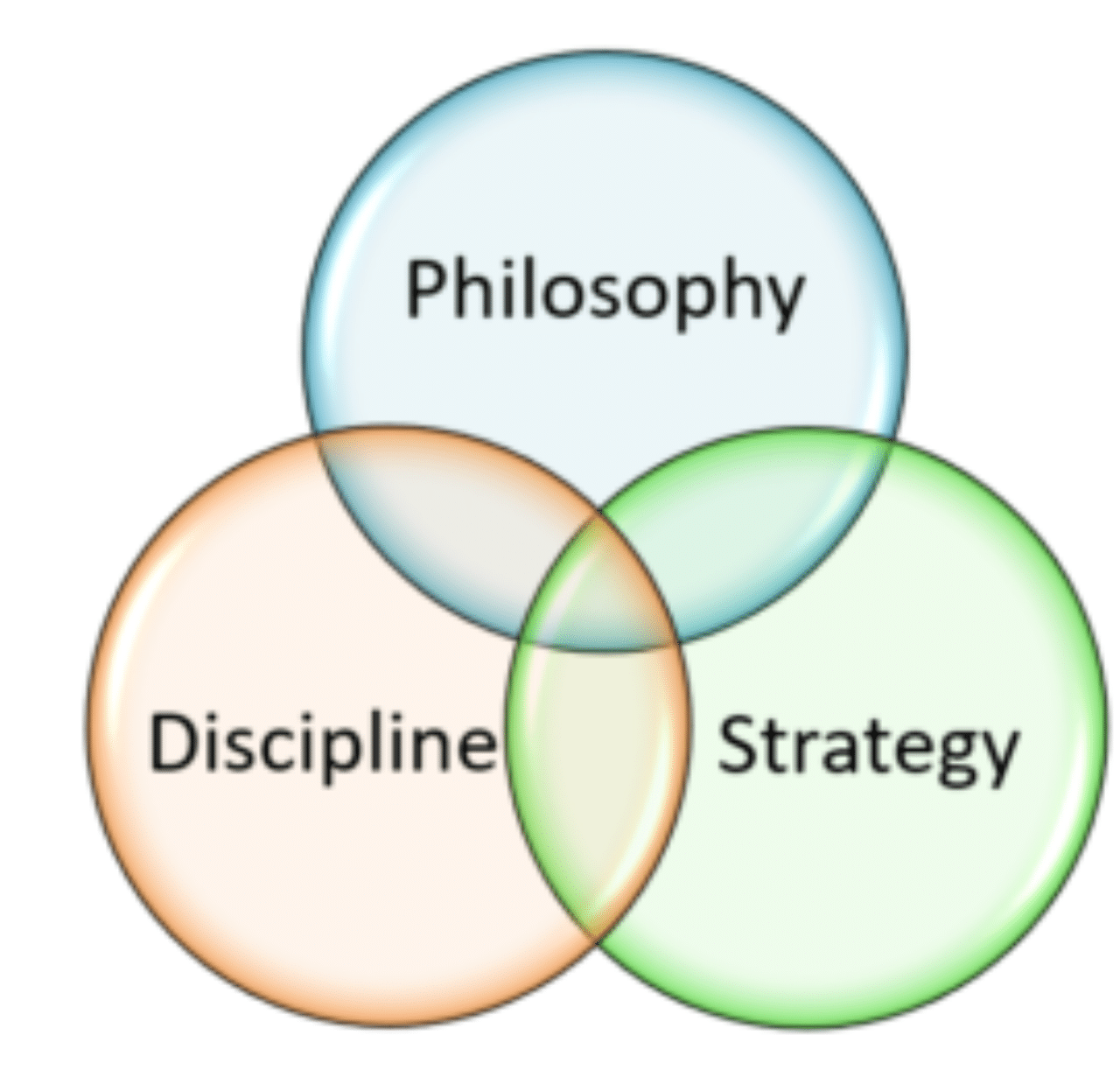

Read moreShore Financial Planning’s Investment Philosophy

The Solution to the Challenge of Investing The real key to successful investing involves disciplined application of three major themes found in modern prudent fiduciary investing: Broad diversification of risk Low costs Low taxes (for taxable investors). These factors allow investors the chance to reduce portfolio risk and enhance long term wealth effectively and efficiently. […]

Read more