Why Free Trades Aren’t Free

Wouldn’t it be amazing if trades were free?

A newer investing platform that comes with its own snazzy app aims to do just that. It’s called Robinhood, and it has become increasingly popular during the pandemic, but are trades on this platform really free?

Not really, and here’s why.

Commonplace Investing Fees

There is really no such thing as a free stock trade. Many people, however, are unaware of the different costs of investing.

The more widely know investing fees include:

- The commission fee to trade a stock – such as $4.95 at Charles Schwab, or “free” at Robinhood

- Taxes on any increases in the value of your investments

- An administrative or a setup fee for a workplace-provided 401(k)

- The fee charged by your financial planner to manage your investments for you – and to invest on your behalf

- Investment fees which could be mutual fund fees, exchange-traded fund (ETF) expense ratios, or the hilariously-high fees of private equity and hedge funds

Many believe that these are the only fees you pay when investing, that is because they are the only fees that are visible.

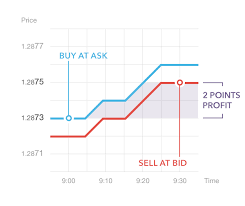

The one fee that you do not see is called the bid ask spread.

Ask Your Financial Advisor About the Bid Ask Spread

Bid ask spreads are where a majority of trading fees are hidden. The spread represents the difference between the price you pay, and the actual trading price of the security. For example, if a stock is trading at 100$, but in order for an investor to purchase it online, they must pay an ask of $100.10. The investor immediately loses $0.10. While this may seem small, it can be double the expense ratio of some low cost mutual funds.

Don’t Fall for Free Trading, Let a CFP Help

If you see a company advertising free trades, think twice before you pull the trigger.

It’s most likely a marketing ploy. You will be paying the bid-ask spread, even if a trade appears to be free. A Fiduciary Advisor will help you minimize your trading costs.